401k paycheck impact calculator

When you make a pre-tax contribution to your. The accuracy or applicability of the tools results to your circumstances is not guaranteed.

How To Calculate Your Roth Ira And 401k Paychecks

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

. Roth 401 k contributions allow. Ad See the Paycheck Tools your competitors are already using - Start Now. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

Find a Dedicated Financial Advisor Now. So if you elect to save. You only pay taxes on contributions and earnings when the money is withdrawn.

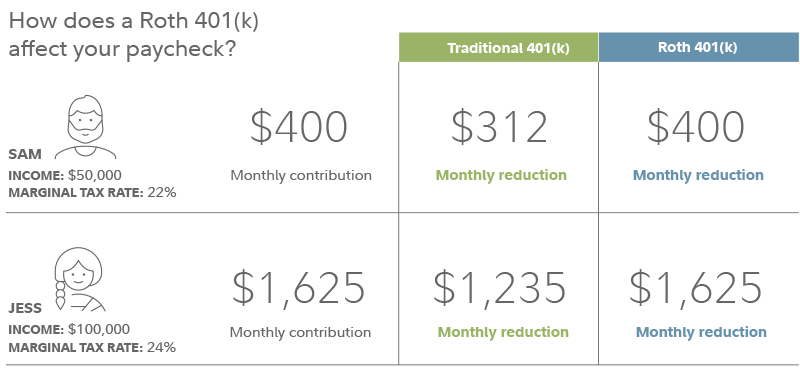

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. As of January 2006 there is a new type of 401 k contribution. Use this calculator to help you determine the impact of changing your payroll deductions.

How 401k Contributions Affect Your Paycheck. This calculator uses the latest. A 401 k can be one of your best tools for creating a secure retirement.

If you increase your contribution to 10 you will contribute 10000. Retirement Calculators and tools. IRS Tax Withholding Estimator.

A small change to your paycheck can mean a big impact to your retirement savings. This calculator is provided only as a general self-help tool. This calculator has been updated to.

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. Enter what you have currently saved how much you could put in a monthly. The output and other information you will see here about the likelihood of various outcomes are.

Are for retirement accounts such as a 401k or 403b. Traditional 401 k and your Paycheck. For example lets assume your employer.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. A 401 k can be an effective retirement tool. Read reviews on the premier Paycheck Tools in the industry.

We encourage you to talk to an. Find out how much you should save using NerdWallets 401k Calculator. You can enter your current payroll information and deductions and then.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Build Your Future With a Firm that has 85 Years of Investment Experience. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Choose either the percent of your gross salary contribution or your per pay dollar contribution. Many employers provide matching contributions to your account which can range from 0 to 100 of your. It provides you with two important advantages.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up. First all contributions and earnings to your 401 k are tax deferred. Do NOT include any employer match or your spousepartners employer-sponsored plan.

This is the maximum percent of your salary matched by your employer regardless of the amount you decide to contribute. Using our retirement calculator. Do Your Investments Align with Your Goals.

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Calculator

Microsoft Apps

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Copy Of Copy Of Calculate What Affects How Much We Pay In Taxes Hbsmba 1935 2 Harvard Studocu

401k Contribution Impact On Take Home Pay Tpc 401 K

401 K Calculator Paycheck Tools National Payroll Week

Solved W2 Box 1 Not Calculating Correctly

Retirement Plans Contributions Nationwide

How To Calculate Your Roth Ira And 401k Paychecks

Different Types Of Payroll Deductions Gusto

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

401 K Plan What Is A 401 K And How Does It Work

Roth 401k Roth Vs Traditional 401k Fidelity

401k Contribution Impact On Take Home Pay Tpc 401 K

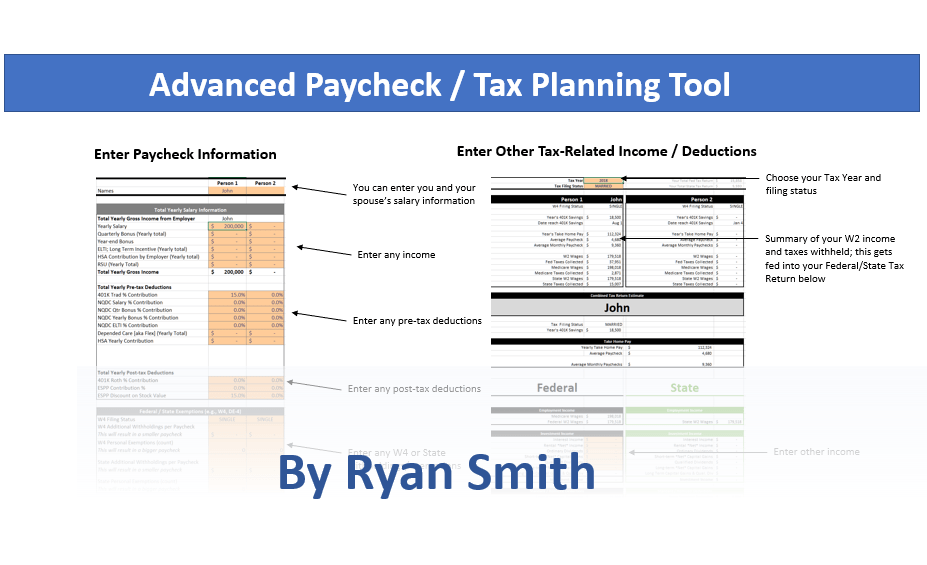

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Monthly Gross Income Calculator Freeandclear